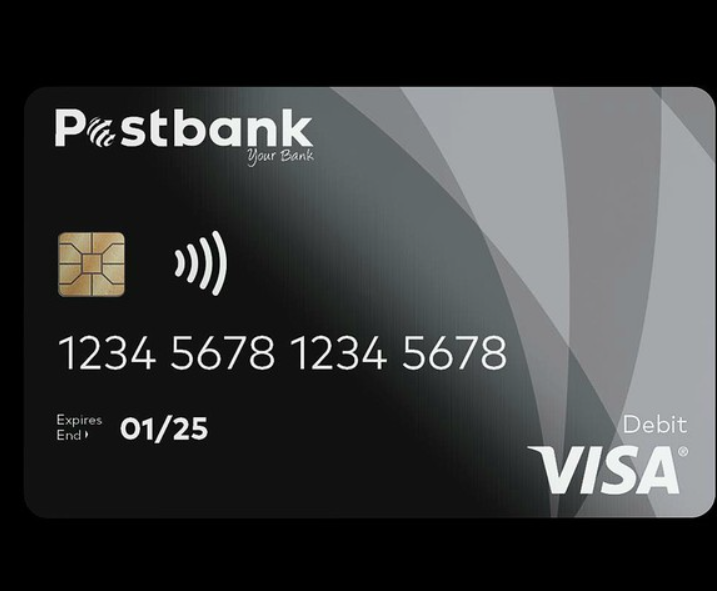

Postbank has started introducing a new Black Card for SASSA beneficiaries. The current Gold Cards were set to expire on 31 December, but Postbank has assured grant recipients that they will be able to access their money into the new year. Photo supplied by SASSA

By Marecia Damons

- Postbank has assured SASSA beneficiaries that their Gold Cards will remain valid until they are replaced with the new Black Cards.

- The Gold Cards were set to expire on 31 December.

- Postbank spokesperson Bongani Diako said the new cards offer enhanced security features, making them safer for beneficiaries.

- A nationwide roll-out has begun in several provinces, with home visits planned for beneficiaries who cannot collect their new cards at retailers.

Postbank has reassured social grant beneficiaries that their existing SASSA Gold Card will continue to work until it is replaced by the new Postbank Black Card.

This comes after confusion over the expiration date of the Gold Card, which was set for 31 December.

Earlier this year, Postbank issued a statement confirming that, even if a Gold Card expired, it would still remain valid throughout 2024. But some beneficiaries reported difficulties accessing their grants, sparking concerns over how the transition to the new cards would affect payments.

A nationwide roll-out of the Postbank Black Card has begun in KwaZulu-Natal, Gauteng, Northern Cape and North West provinces.

Postbank spokesperson Bongani Diako said, “Gold Card beneficiaries in areas where we have not yet started issuing Black Cards need not be concerned as we will be taking the cards to where they live in every part of the country. Their Gold Cards will continue to work until we issue them with new Black Cards.

“So, they must ignore any conflicting information, including any advice that they must change their payment method,” Diako said.

He said the new cards have enhanced security features and are compliant with updated banking standards, providing a more secure and efficient method for receiving grants.

“It is EMV-compliant with the updated EMV (Europay, Mastercard and Visa) standards which is a standard compliance required from all banks to replace cards after a certain period,” he said.

Postbank has not set a date for the completion of the transition to the new cards. “The transition will be completed once every Gold Card has been replaced,” Diako said. He said Postbank serves “less than 30%” of SASSA’s 28-million grant recipients.

Postbank has introduced a special programme to assist bedridden and elderly beneficiaries who cannot travel to collect their new cards. This initiative includes home visits with Postbank representatives delivering Black Cards directly to beneficiaries’ homes. Although details on how to schedule these visits have not yet been released, Diako confirmed that the programme would be available in the coming weeks.

Beneficiaries who wish to collect their new Black Cards must take either their ID or a temporary ID to selected retailers. If someone is collecting a card on behalf of a beneficiary, the beneficiary does not need to be present, says Postbank, but the person collecting the card must present an official SASSA authorisation letter.

Grant recipients will have the same benefits they had with the Gold Cards, said Diako, including: free first card replacements if lost or stolen; three free withdrawals per month in stores; one free monthly statement over the counter; and no unauthorised deductions.

Beneficiaries who are asylum seekers need to bring an official approval letter from SASSA to get their new card.

“A lot of work has been done in the bank in the past 14 months to ensure that Postbank is on par as much as possible with other banks when it comes to our core banking systems,” Diako said.

He said the focus is on getting the new card to every gold card user “with the SASSA customer being our priority”. After that, Diako said the plan is to “firm up our national presence”.

“We are building a new Postbank,” Diako adds.

Follow African Insider on Facebook, Twitter and Instagram

Picture: GroundUp

For more African news, visit Africaninsider.com