In a first for the nation, Sierra Leone has launched a blockchain-based digital identity system.

The National Digital Identity Platform (NDIP), developed in a partnership between the government and microfinance company Kiva, provides citizens with digital identities.

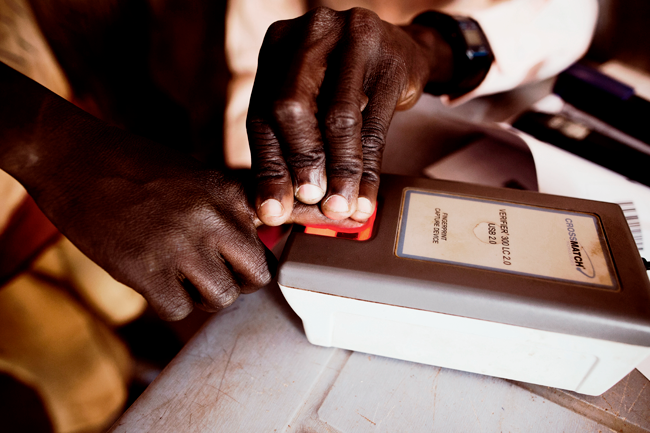

According to Kiva, a thumb print and ID number are all it takes be signed up to the digital system. The NDIP is expected to provide people with easier access to finance, as it will enable them to open accounts at formal banking institutions. The system also provides access to other financial services such as loans, which were previously unobtainable due to a lack of identification and a verifiable credit history.

Lending institutions typically offer rural farmers and traders either high-interest loans or refuse credit to avoid risk, President Julius Maada Bio said at the launch of the initiative. ‘The bank has no way of establishing the identity or credit history of that person or small business entity. With the new NDIP, financial service providers are now able to efficiently verify the identity and ultimately the credit history of a customer wanting to open an account or access a loan. This in itself reduces the risks to these institutions associated with extending low-interest credit to “unknown” borrowers.’