There’s a reason why the world’s biggest tech companies are always a step ahead of the rest. Whether it’s Microsoft, Amazon, Huawei or China Telecom Global – or any other digital giant, for that matter – they all have one thing in common: through increasing presence in the cloud, they deliver speed and reliability of service, powered by data centres. Specifically, hyperscale data centres.

‘Digital transformation is reshaping every industry and sector, because of agile technologies like software-defined data centres,’ according to Sameer Cassim, R&D systems architect at Internet Solutions (a Dimension Data Group subsidiary, which itself has more than 12 000 m2 of data centre space across Africa). ‘Companies are moving their workloads into the cloud due to ageing infrastructure and escalating costs, with many of these cloud computing services being delivered through hyperscale data centres.’

‘Hyperscale’ refers to the ability to respond (or scale) hugely and quickly, increasing computing ability, memory, networking infrastructure or storage resources to meet a sudden spike in demand. It’s not as much about scaling up (adding more power) as it is about scaling out (adding more capacity). Those hyperscale data centres are what allow Amazon, for example, to trade seamlessly through Black Friday and Cyber Monday, without its e-commerce site crashing.

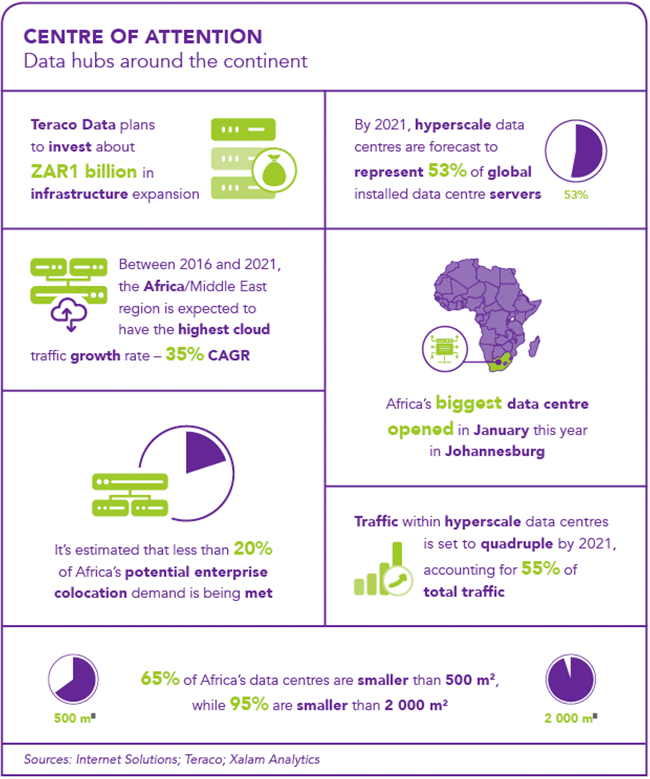

Cassim cited research from Cisco, which predicts hyperscale data centres will constitute 53% of the total installed data centre servers between 2016 and 2021, and account for 55% of all data centre traffic by 2021. In South Africa, ‘catering to hyperscalers’ resource-intensive requirements involves overcoming a number of challenges – not least of which is the ability to access a reliable electricity supply from the municipality or Eskom’.

Yet while those challenges have previously slowed cloud adaptation – and data centre infrastructure development – in Africa, the continent’s data centre boom is now well and truly here. A new report by Xalam Analytics, titled the African Data Centre Boom, states: ‘After years of strong promise but relatively slow expansion outside of South Africa, the African data centre market has entered a phase of accelerated growth. The year 2018 marks an inflection point. More multi-tenant data centre facilities will be built across Africa over the next two years than were established over the past three combined. Data centre colocation space, power and revenue are all set to double over the next five years.’ And those global tech giants are driving that growth.

In October, Amazon Web Services (AWS), the world’s largest cloud computing provider, announced that it would open an infrastructure region in South Africa in the first half of 2020. ‘Having built the original version of Amazon EC2 [Elastic Compute Cloud] in our Cape Town development centre 14 years ago, and with thousands of African companies using AWS for years, we’ve been able to witness first-hand the technical talent and potential in Africa,’ according to AWS CEO Andy Jassy. ‘Technology has the opportunity to transform lives and economies across Africa, and we’re excited about AWS and the cloud being a meaningful part of that transformation.’

AWS’ announcement further stated that the addition of the AWS Africa (Cape Town) region would ‘enable organisations to provide lower latency to end users across sub-Saharan Africa and will enable more African organisa-tions to leverage advanced technologies such as artificial intelligence, machine learning, the internet of things, mobile services and more to drive innovation’.

Local AWS customers will also be able to store their data in South Africa with the assurance that their content will not move without consent, while those looking to comply with the upcoming Protection of Personal Information Act (POPIA) will have access to secure infrastructure that meets the most rigorous international compliance standards. The announcement came only two months before Microsoft’s launch of two South African Azure data centres, and days after Huawei revealed plans for its first African public cloud data centre.

Also in late 2018, China Telecom Global’s (CTG) Middle East/Africa subsidiary announced it was establishing an inter-connection network and telecoms hub to support growing traffic demands at Teraco Data Environments, Africa’s first vendor-neutral data centre. ‘For Teraco, the CTG expansion means increased global reach for clients within the data centre facility looking to access Asian markets,’ says Carla Sanderson, Teraco’s head of marketing. ‘The CTG network footprint is a significant one – the ability to buy services from CTG within the Teraco data centre means clients are able to leverage that network and reach new markets.’

While Teraco is a relative newcomer to the data centre environment (the company only recently celebrated 10 years in the industry), it has, however, been operational during a very exciting time. ‘The data centre has come of age,’ says Sanderson. ‘More organisations each day are recognising the need for purpose-built, high-availability infrastructure that allows them to start their digital journey to bring products and services closer to clients. Business is increasingly being transacted online. Some of the most recent developments we have noted are the increased demand for access to cloud services, often to multiple cloud services providers – and the growing need for hyperscale data centre facilities by many internet companies and larger organisations.’

Without question, a boom is happening – and the implications for African businesses are significant. Sanderson says the local infrastructure boom alone is enabling businesses to take advantage of all the benefits of digital transformation and cloud technologies. ‘Increased access to data centre infrastructure means organisations can outsource infrastructure requirements and focus on their core business,’ she says.

While many organisations have discussed migrating to the cloud for the past several years, 2018 saw a significant push towards these services, says Karl Reed, chief solutions officer at Elingo. ‘Part of this can be attributed to wanting to see whether the hype is justified, while another part has been waiting for technology to be available that makes the transition as cost-effective as possible.’

Pointing to the Microsoft and AWS developments, Reed says that Africa’s business decision-makers are ‘sitting up and taking notice and relooking their previous sceptical views of the cloud’, as more use cases emerge across industry sectors. ‘From our side, we have also been having discussions with clients that previously only wanted on-premises solutions but now want to migrate to the cloud,’ he adds. ‘Contributing to this is how cloud services support the likes of GDPR [the EU’s General Data Protection Regulations] and POPIA while still meeting security requirements, and provide a “pay-as-you-use” model. Today, executives are asking whether the cloud is right for their business as opposed to simply chasing service providers out of the room.

‘They now understand the importance of the cloud and how it can be customised to very specific requirements. In my experience, 90% of customers are perfect for the cloud, where previously it might have been around 10%.’ It would not have come as too much of a surprise, then, when regional data centre investment firm First Brick Holdings announced at the sidelines of 2018’s AfricaCom Digital Week in Cape Town, South Africa, that it was investing US$50 million in data centres across East Africa – starting with Uganda’s first Tier III, carrier-neutral centre at the Kampala Industrial and Business Park in Namanve.

‘Data centre installations in East Africa are lagging behind other emerging economies, despite the region facing similar underlying trends in terms of the growth of data usage and storage requirements,’ according to James Byaruhanga, GM of the new data centre. ‘Businesses in Uganda are seeing their data requirements become increasingly more sophisticated and subject to data sovereignty compliance rules that necessitate local data storage and processing. These dynamics, coupled with the expansion ambitions of some of the world’s biggest companies who are either already active in or looking to expand into the East African market, are driving the commercial need for data centres.’

In South Africa, listed retailer Pick n Pay provides a useful case study. The company recently moved its e-commerce and data analytics systems from a managed services model to AWS, with Chris Shortt, the retailer’s GM of information services, saying that it had resulted in ‘significant savings’ on Pick n Pay’s total cost of ownership over the past year. ‘The relationship, performance, reliability, and cost savings has been positive and has led us to move our SAP Business Warehouse systems to certified AWS X1 instances,’ he says.

‘Selecting AWS highlights the differentiated, cloud-first thinking they bring to us as opposed to more traditional, and less agile, service providers. The scale, security, speed, and customer-focused nature of AWS is something we’ve become accustomed to and look forward to expanding our use of their services as [the AWS] South African region becomes a reality.’

Or, as Reed puts it: ‘We have finally reached the point where the technology is available today to do what analysts were promising five years ago. While the seeds have been planted [last year], 2019 is going to be an exciting one for the cloud in South Africa and the African continent.’