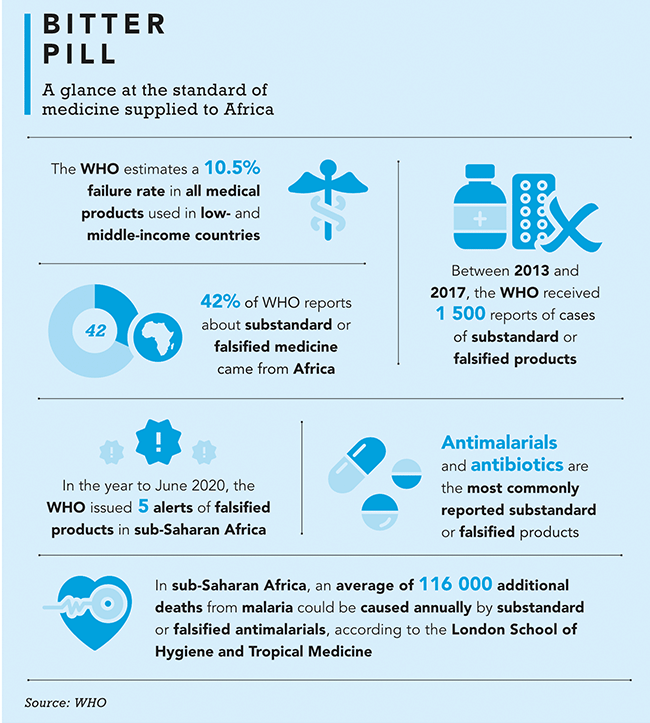

Africa is home to killer diseases, from malaria, TB, HIV/Aids, diabetes and cardiovascular disease to Ebola and now COVID-19. Yet less than 2% of the medical drugs consumed on the continent are produced there, notes the UN. Some are donated by relief organisations, but more than 80% are imported, adding to the financial burden of governments (most Africans rely on public health facilities) and the patients who must pay for them in one of the poorest parts of the planet. What’s more, the WHO reports that one in 10 medical drugs that make their way to the continent is fake or substandard.

Small wonder that a number of African governments have been considering developing more local production for some time. As far back as 2005, the Assembly of AU Heads of State mandated the development of the Pharmaceutical Manufacturing Plan for Africa (PMPA). But according to a recent analysis of the pharmaceuticals market in sub-Saharan Africa by strategic management consultants McKinsey, in most countries a manufacturing hub is simply ‘unlikely to be economical’. In a half dozen, it could be – if obstacles such as relatively small markets, unreliable infrastructure and an undeveloped talent base can be overcome. In these countries, it believes a local industry would make drugs ‘modestly more affordable’, improving public access to them at a critical stage when donor programme funds are drying up under the pressure of the COVID-19 pandemic.

At the moment, there are some 375 pharmaceutical manufacturers in Africa, serving a population of 1.34 billion. Most are in North Africa. Those in sub-Saharan Africa are small and fail to meet international standards, says McKinsey. Only South Africa, Nigeria and Kenya have a sizeable industry, producing for their local markets and neighbouring states. Nearly all these manufacturers buy active pharmaceutical ingredients (APIs) from elsewhere and formulate them into pills, capsules, syrups or creams. Just three companies – two in South Africa; the third in Ghana – produce APIs themselves. It is invariably cheaper to produce them in India, as plants in Africa have less capacity and lower utilisation rates. But McKinsey suggests that with ‘comparable facilities’, some locally produced drugs could in future be as cheap as – or even cheaper than – imports, considering the lower transport cost to reach distributors.

The advantages of local production would not only be more affordable drugs, but more effective ones, given that apart from the issue of fake imports, some global drug manufacturers are reported to supply outdated drugs to Africa, lacking the incentive to register and promote all their products for every relatively small African country. The result is that African countries often use drugs older than those on the WHO’s list of essential medicines (those considered most effective and safest). Local production tends to bring regulation and quality assurance. In Ethiopia, for example, moves by the government to encourage local drug manufacturing in turn brought moves to boost its national drug-regulation body, and to ensure manufacturers meet the standards required for exports, according to a WHO report.

‘Overall, our analysis convinced us that increased local drug production is feasible in about a half-dozen sub-Saharan countries at current and projected levels,’ the McKinsey analyses concludes. ‘While only South Africa is currently as attractive to private-sector pharmaceutical investors as Brazil and India, other countries have been rapidly improving their investment climate.’ Key, the report notes, will be creating regional hubs that include smaller African countries – and there is already a move to facilitate freer trade across the continent, with the launch of the African Continental Free Trade Area (AfCFTA) to bring together the 55 members of the AU and lift barriers to trade.

The COVID-19 pandemic has made this more imperative than ever, exposing the continent’s ‘inadequate capabilities and capacity to manufacture and supply essential protective equipment needed to curb the disease’, writes Janet Byaruhanga, senior programme officer in public health at the AU Development Agency, in the UN’s Africa Renewal publication in September 2020. Byaruhanga describes Africa’s high ratio of imported pharmaceuticals as ‘unsustainable’. But she is confident about the future, pointing out that when all African countries ratify the AfCFTA, ‘it will integrate a market of 1.3 billion people and potentially 2.2 billion by 2050’, giving African manufacturers ‘significant economies of scale and scope’. Free trade under the AfCFTA officially started on 1 January 2021. ‘A pooled procurement mechanism will encourage leading global generic pharmaceutical manufacturers to build plants in Africa or partner with African pharmaceutical companies to manufacture generic products,’ she says.

Existing African pharmaceutical manufacturers have already been brought into a federation to enable them to share information and business intelligence, and to have a ‘unified voice’, according to Byaruhanga. Plans are under way to establish a fund for the sector. She notes that countries will need to formulate education policies ‘that foster research and development in pharmaceuticals’ and strengthen their regulatory systems ‘to ensure that local manufacturers adhere to international standards’. She is upbeat. ‘When fully implemented, the PMPA will create jobs for millions of Africa’s unemployed and usher in a knowledge economy that will drive the Fourth Industrial Revolution.’ But will it be in time to help with the current crisis of COVID-19 and the most important roll-out of our age – medications to treat it, and the jackpot: a vaccine against it?

From a COVID-19 treatment perspective, Durban-based Aspen Pharmacare, one of Africa’s largest pharmaceutical manufacturers, announced in June 2020 that it could provide 10 million tablets a month of dexamethasone – a steroidal drug shown by Oxford scientists to cut death rates by around a third in severely ill patients hospitalised with the virus. ‘We can also supply the injectable form, and we’d look to ramp up further should there be a need for additional product,’ says group chief executive Stephen Saad. The South African government has asked Aspen to source the drug for use in the domestic market and the African continent, and Saad adds that the company has also received enquiries from the WHO, UNICEF and other agencies.

Then, in November, Aspen announced a major milestone: it entered a preliminary agreement with Johnson & Johnson for ‘the technical transfer and proposed commercial manufacture of their COVID-19 vaccine candidate’ at Aspen’s state-of-the-art sterile manufacturing facility in Port Elizabeth. Once all approvals are in place, Aspen hopes to go into production as soon as March or April this year. ‘Our production area has capacity to produce more than 300 million vaccine doses a year,’ says Saad. ‘We’ve invested globally in our sterile capacity and are determined to play a role in the manufacture of vaccines to add to our track record of making contributions to humanity in times of global pandemics.’ This has included being a global supplier for antiretrovirals for the treatment of HIV/Aids and multi-drug-resistant-TB products.

Until this development, there had been only one vaccine manufacturer in Southern Africa – the Biovac Institute, a Cape Town-based bio-pharmaceutical company that is part-owned by the government. In October it announced that it was in talks to manufacture COVID-19 vaccines. According to CEO Morena Makhoana, it could produce up to 30 million doses a year – ‘enough for a quarter or half of South Africa’s population, depending on whether the vaccines require one or two doses’ – but the process would take time.

‘Biovac is in talks with multiple stakeholders within the global vaccine landscape with regard to the local manufacture of possible COVID-19 vaccines,’ says Makhoana. ‘These stakeholders are a part of global pharmaceutical companies, institutions and other organisations. At this time we’re unable to disclose the nature of these discussions.’ There are just three other vaccine manufacturers in Africa – in Senegal, Egypt and Tunisia – and they are small, ageing facilities. ‘Ours is a world-class, modern facility and South Africa has stringent industry regulations, essential if working with international vaccine developers,’ he says.

Biovac is already working with global pharmaceutical giant Sanofi to produce the core six-in-one paediatric vaccine (diphtheria, tetanus, pertussis, hepatitis B, haemophilus influenza B and polio), which was introduced a few years ago in the national immunisation programme. ‘We’ve been doing the packaging and labelling for five years – now we’ve just been approved by the South Africa Health Products Regulatory Authority to manufacture it under sterile conditions.’ It’s the first technology transfer of this vaccine by Sanofi to an external partner. And as Makhoana puts it, ‘the local manufacturing of vaccines will strengthen our position in responding to local and regional diseases, and prepare us for future pandemic readiness’.