The business – and busyness – began early on Friday morning, peaking between 8am and 9am and continuing throughout the weekend until late on Monday. And amid all the clicks and checkouts, SA’s retailers enjoyed a 2018 Black Friday/Cyber Monday weekend that shattered records and exceeded expectations. BankservAfrica, Africa’s largest automated payments clearing house, released figures showing that it processed 581 189 online transactions over the period (23 to 26 November 2018), with South Africans making 404 594 online transactions on Black Friday (up 55% from 2017) and 176 595 on Cyber Monday (up 36% year on year). ‘This year’s Black Friday and Cyber Monday figures surpassed 2017’s with more South Africans taking to online to do their transactions,’ Martin Grunewald, executive head: payments business at BankservAfrica, said in a statement. ‘The year-on-year growth certainly reflects the growing popularity of these major shopping days despite the tougher economy experienced.’

Payment service provider DPO PayGate shared similar results, highlighting how retailers and payment facilitators had worked to minimise the server crashes and website timeouts that had bedevilled previous Black Fridays. ‘We were really impressed with the overall preparedness for the event this year,’ says DPO PayGate MD Peter Harvey. ‘Merchants made sure warehouses were stocked and customers were alerted to deals well ahead of time. The banks had set up war rooms to monitor and respond to any challenges, and the lines of communication between industry players was phenomenal.’ Harvey added that shoppers were also better prepared in 2018, with many queuing up ahead of time, causing – as he put it – ‘a checkout tsunami at midnight on Friday when the deals opened’.

In planning for the event, DPO PayGate tripled its infrastructure from 2017 (already double that of 2016). ‘Even this was placed under pressure when the wave hit between 12am and 1am,’ says Harvey. ‘We were able to liaise with our merchants and, with some planned downtime later in the day, we were able to again double our existing capacity in just 15 minutes – something that would have taken hours or days just a few years ago.’

Those growing numbers – and the endless marketing hype surrounding those busy online and real-life shopping days in late November – suggest that Africa’s e-commerce industry is coming of age. As Harvey notes: ‘Apart from the significant year-on-year growth in transaction volumes, the number of smaller merchants who are either augmenting their offline offering with online services, or opening standalone online stores, shows that the market believes in the e-commerce opportunity.’

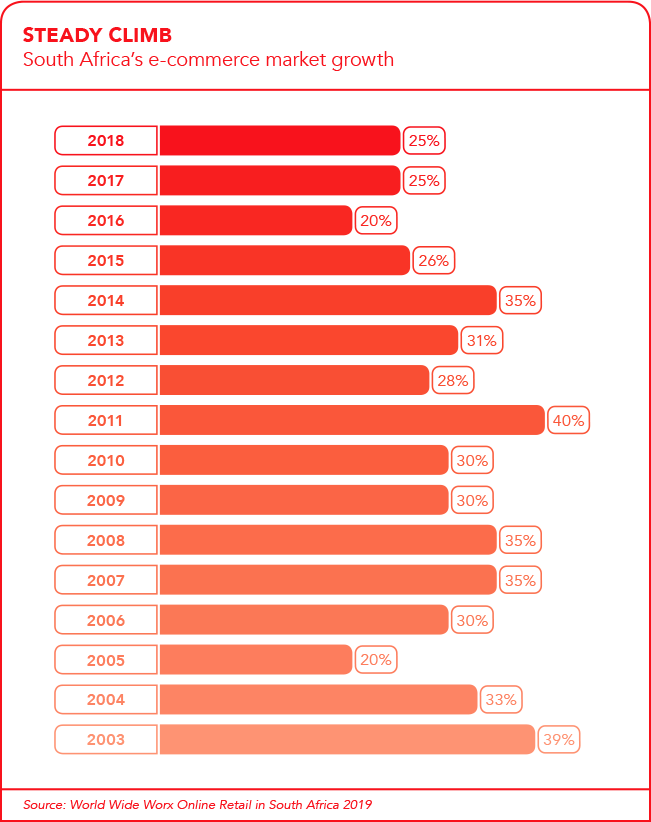

It’s foolish to draw conclusions on the state of an industry based on a single – and intensively advertised – weekend of pre-Christmas sales. The Online Retail in South Africa 2019 study published in November by World Wide Worx found that while the year-on-year growth since 2003 in online shopping has not dropped below 20%, there is ‘still a long way to go before online retail is normalised in South Africa and becomes a mainstream natural route to purchasing’.

While SA’s online shoppers were expected to spend around ZAR14 billion in 2018, that’s still less than 2% of total revenue spend. However, the report notes that while online retailers in SA still make up a small proportion of overall retail, ‘for the first time we see the promise of a broader range of businesses in terms of category, size, turnover and employee numbers. This is a sign that our local market is beginning to mature’.

The same is true across Africa in general – but as you move into the continent’s various regional markets, the picture becomes increasingly complex. In December 2018, ahead of Africa E-commerce Week, the UN Conference on Trade and Development (UNCTAD) released its Business-to-Consumer (B2C) E-commerce Index, which rated 151 countries on their readiness to trade online. Some 43 African countries featured in the index, but the highest-ranked of them – Mauritius – placed only 55th in the world. Of the rest, nine African nations made up the bottom 10.

‘Africa trails behind the rest of the world in its preparedness to engage in and benefit from the digital economy,’ said UNCTAD secretary-general Mukhisa Kituyi. ‘However, the continent is showing progress in key indicators related to B2C e-commerce. Since 2014, sub-Saharan Africa has surpassed world growth on three out of the four indicators used in the index. We estimate that there were at least 21 million online shoppers in Africa last year, less than 2% of the world total, with three countries – Nigeria, South Africa and Kenya – accounting for almost half of that number. Nevertheless, the number of African online shoppers has surged annually by 18% since 2014, faster than the world average growth rate of 12%.’

Speaking later at the opening of Africa e-Commerce Week in Nairobi, Kituyi said e-commerce had grown phenomenally across the globe, but even so, its growth remained constrained. ‘It’s very clear that e-commerce and the digital economy do not happen by accident but as a result of purposeful actions,’ he said, calling on governments to create policy frameworks, invest in the right skills, protect the integrity of payment systems, and construct roads and delivery networks. Kituyi described a sense of urgency that Africa was being left out of the discourse on e-commerce that had already taken place elsewhere, saying that ‘the appetite is growing, but the laggards lie on this continent’.

Finally, he said that building e-commerce ecosystems in Africa was not only about consumers being enabled to buy goods ‘made in India, made in China’, but also for the world to buy merchandise ‘made in Africa’. And there he hit on a point that Jessica Anuna, owner of online retailer Klasha, would later pick up on. During a brief statement at the opening session of the conference, she told delegates that the barriers to e-commerce in Africa were almost prohibitively high. ‘As a young company and a start-up operating on the continent of Africa, one of the main barriers that we are experiencing is inter-African trade,’ she said.

‘We’re actually a fashion start-up based in Nigeria and we ship to millennials all across Africa. We have just entered the African continent. Surprisingly, we haven’t received a lot of backlash or difficulties actually entering the African continent, but the difficulties have been shipping to various parts of Africa. As a retailer, it’s cheaper for me to ship from certain parts of Asia to Africa and from Nigeria to certain parts of West Africa – and that shouldn’t be the case. The ease of doing business across African borders is something that we need to address on a policy level and also [on an] investment level.’

Vera Songwe, executive secretary of the Economic Commission for Africa (ECA), responded to Anuna’s call by framing it as a question of how African countries could build the systems that would allow them to compete in global markets, and identify the right e-commerce strategies. ‘We at the ECA say this must be done within the context of the African Continental Free Trade Agreement, and that Africa has a long way to go in intra-continental levels of trade compared to other global regions,’ she said. ‘As we start our drive to deeper trading we must ensure that no one is left behind.’ Songwe emphasised that inclusive, harmonised trade was critical to ensuring that ‘Angola can talk to Egypt and Zimbabwe can talk to Senegal’. Or one could add, at the very least, that retailers like Klasha in Nigeria can talk to their suppliers elsewhere in Nigeria, or their customers over the border in Cameroon or across the gulf in Ghana.

As South Africa’s Black Friday and Cyber Monday experiences showed, African e-commerce already has the necessary tech structures in place to allow for smooth online retail.

With the appropriate enabling regulatory environment in place, and with the continued growth in internet penetration across the continent, it surely can’t be long before every Friday and every Monday feature the clicks and taps of busy online shopping.