Cape Town – The South African Revenue Service (SARS) has announced that its preliminary revenue collection results for the 2022/2023 financial year came to a gross amount of R2,067.8 billion.

The net collection after payment of R381.1 billion in refunds was R1,686.7 billion.

SARS said it was the most it had collected since its inception. The amount paid in refunds was also the largest ever paid.

The results reflected a significant growth trajectory over the past few years.

The 2023 gross amount represents an increase of 9.7% over the 2022 collection of R1,884.9 billion, while the 2023 refunds represent an increase of 18.7% over 2022’s R321.1 billion. The 2023 net revenue collected represents year-on-year an increase of 7.9% over the net 2022 amount of R1,563.8 billion.

The net amount of R1687 billion against the 2021/22 outcome of R1,564 billion represents a year-on-year R123 billion increase.

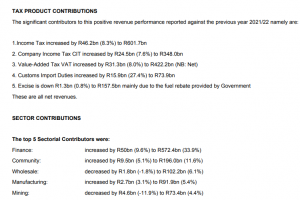

Compared to the 2022 revenue outcome, growth was recorded in all tax types. Personal income tax (PIT) grew 8.3% to R601.7bn; company income tax (CIT) grew by 7.6% to R348bn; Value-Added Tax (VAT) grew by 8.0% to R422.2bn; and Customs and other taxes grew by 27.4% to R73.9bn.

Compliance revenue, resulting from targeted interventions across all segments of taxpayers, yielded R227bn in revenue, compared to last year’s figure of R215.4bn. According to the revenue service, these interventions included focused debt collection, a focus on criminal and illicit activities, and declaration compliance among large businesses.

SARS added that other gains this year include an increase in positive public sentiment, measured by a public opinion survey from 71.8% in 2021/22 to 76.5% in 2022/23.

“The 2023 financial year end results are an important indicator of SARS’ commitment to implementing its legal mandate of collecting all revenue due, promoting a culture of compliance and facilitating legitimate trade,” the revenue service said.

ALSO READ | Eskom disclosure exemption ‘a major blow’ for SA

SARS Commissioner Edward Kieswetter thanked the staff of SARS, taxpayers, and traders for contributing to the revenue outcome.

“SARS employees, compliant taxpayers and traders, tax practitioners, citizens, as well as other stakeholders in the tax eco-system, are all nation builders as we work together towards the goal of deepening our democracy and overcoming the challenges of high levels of poverty, unemployment and inequality.

“The challenge may seem daunting at times, but we must continue to play this privileged role of building our nation through maximising revenue collection, facilitating legitimate trade, improving voluntary compliance and rooting out fraud and corruption, as the Father of our Nation Mr Nelson Mandela put it, ‘it is all in our hands’.”

Follow African Insider on Facebook, Twitter and Instagram

Picture: SARS

For more African news, visit Africaninsider.com

Compiled by Junaid Benjamin