South African consumers received a bit of good news after the South African Reserve Bank (SARB) announced on Thursday afternoon that it would not raise interest rates – for now.

EWN reported that the central bank decided against extending its run of 10 consecutive rate hikes, leaving the repo rate unchanged at 8.25%.

Quoting economist Dale McKinley, it said the decision will come as a relief to debtors paying off large loans because they won’t be paying more.

The news came off the back of StatsSA’s report that the inflation rate had slowed from 6.3% in May to 5.4% last month – the lowest reading since 5 % in October 2021. The slowing rate brings it back in line with the SARB’s monetary policy target range of between 3% and 6%, reports BusinessTech.

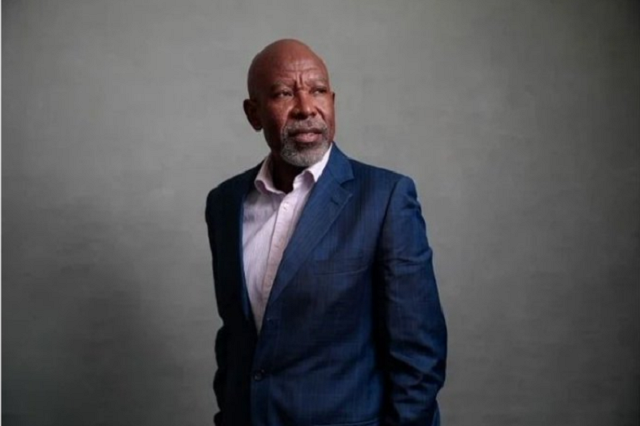

However, SARB governor Lesetja Kganyago was at pains to point out that the central bank is not ready to completely remove its foot off the brakes just yet.

“Have interest rates peaked? The answer is a resounding no,” Kganyago was quoted as saying in Daily Maverick. “Is this the end of the hiking cycle? No, it is not. It depends on the data and risks, that is what it boils down to.”

Follow African Insider on Facebook, Twitter and Instagram

Picture: Image: Twitter/@Richards_Karin

For more African news, visit Africaninsider.com

Compiled by Robyn Leary