There are many reasons to advocate for the adoption of modern technology in farming; chief among them are the proven impact that productivity growth in agriculture can have on poverty reduction, and the opportunity that many of these new technologies represent in supporting the farming sector to adapt to climate change.

Since the first biotechnology (biotech) crops were planted on a commercial scale in 1996 these crops have played a substantial role in addressing global food production constraints by enabling many farmers across the world to increase yields of major staple and important economic crops such as maize, soya beans, cotton and rice. However, what makes this increase in production even more significant, is the simultaneous improvement in productive resource use. Farmers with access to modern farming technology, such as improved seed and plant material, have been able to realise greater outputs, while reducing the rate at which their use of resources such as land, water and farming inputs have increased. Essentially, farmers are doing more, with less.

The shift that has occurred in agriculture globally over the past five decades, from resource-led to productivity-led growth, is described in the World Bank’s September 2019 report on technology and productivity in agriculture. It says that rather than increasing agricultural output by expanding the amount of land, water and input used, most agricultural growth has come from increasing total factor productivity of these resources, or the efficiency with which these inputs are combined. Farmers have been able to increase efficiency by making use of improved technology.

According to the report, improvement in total factor productivity accounted for more than two-thirds of agricultural growth globally from 2001 to 2015, and nearly 60% of the agricultural growth in developing countries.

Wide disparities, however, exist between countries in the rate of improvement. The report states that in East Asia, crop yields have increased six-fold in the past 40 years, contributing to the significant reduction in poverty in China and other East Asian countries. However, crop yields in sub-Saharan Africa and parts of South Asia have only doubled. The regions that experienced lower crop-yield growth also saw lower reductions in poverty. The use of other modern farming technologies such as irrigation, fertiliser, and tractor use in Africa remains very low, compared with utilisation rates in other developing regions.

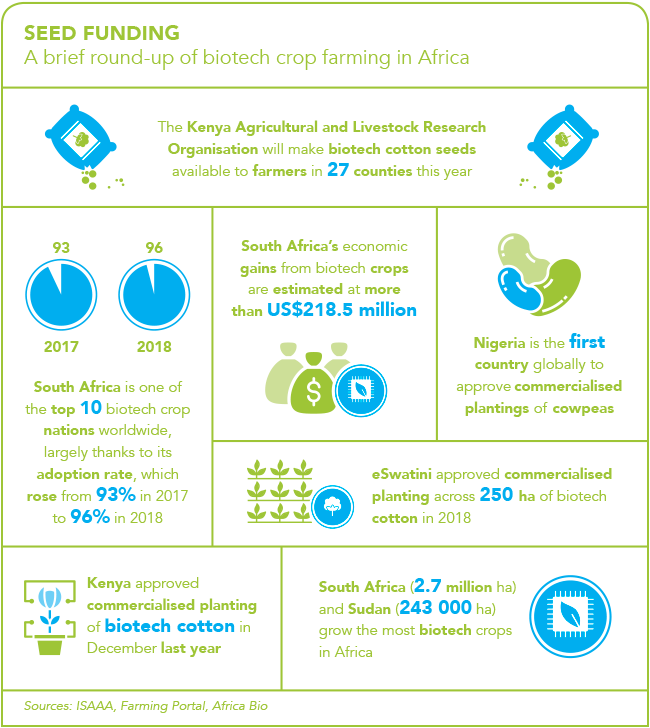

In its most recent report on the status of biotech crops worldwide, the International Service for the Acquisition of Agri-biotech Applications (ISAAA) notes that the global area planted with these crop varieties increased exponentially from 1.7 million ha in 1996 to 191.7 million ha in 2018, making biotech crops the fastest adopted crop technology in recent times. But in Africa, very few countries have developed enabling legislation to allow planting of biotech crops such as genetically modified (GM) maize and soya beans. Only three countries in Africa, out of 26 worldwide, planted biotech crops in 2018, according to the report. The three nations are eSwatini (which started commercial planting of biotech cotton on 250 ha); South Africa (the ninth-largest grower of biotech crops in the world with 2.7 million ha), and Sudan (with 243 000 ha under biotech cotton).

The report also states that two more African countries – Kenya and Malawi – earlier granted environmental release approvals for biotech crops and were working towards commercialisation of biotech cotton. In 2018, Nigeria became the first country in the world to approve biotech cowpeas, and Ethiopia and Nigeria gave environmental release approvals for biotech cotton.

Despite these advances, the 3.14 million ha planted with biotech crops in Africa represents just a fraction – approximately 1.64% – of the 191.7 million ha of these crops planted worldwide in 2018.

In South Africa, the one notable exception among African countries, farmers have enjoyed several benefits due to the large-scale adoption of GM varieties of maize, soya beans and cotton since this technology was first introduced in the country in 1998. The Agricultural Biotechnology Annual published in 2019 by the US Department of Agriculture, notes that within the space of two decades, from the 1990s to the 2010s, average maize yield in South Africa more than doubled from about 2.2t/ha to 4.5t/ha. The main reasons for this, the report says, are ‘more efficient and effective farming methods and practices, the use of less marginal land in the [maize] production systems, better seed cultivars, and the adoption of biotech’.

South Africa’s average biotech crop adoption for cotton, maize and soya beans stood at 96% of total plantings of these crops in 2018, according to the ISAAA report. It also quotes other research, which shows that the direct monetary farm-level benefits of GM crop adoption in South Africa, have been considerable, with the economic gains from biotech crops for South Africa for the period 1998 to 2016 having amounted to about US$2.3 billion.

Apart from further developments for South Africa’s main biotech crops (maize, soya beans and cotton), other biotech crops and products still in the development phase include improved grapevine and wine micro-organisms, by the Institute for Wine Biotechnology at Stellenbosch University, as well as improved sugarcane with traits such as drought tolerance, disease resistance and herbicide tolerance, by the South African Sugarcane Research Institute.

The AU has set a target of 6% annual growth, on average, in agricultural productivity across the continent, write Joel Ochieng and Anthony Ananga in a 2019 article on agricultural policies for biotech in sub-Saharan Africa. But, as the authors note, achieving this target will require widespread adoption of advanced technologies coupled with strong policy support. In fact, they state, achieving a 6% agricultural productivity growth rate will need ‘unprecedented policy support from African governments and international development partners’.

According to Ochieng and Ananga, the extent to which biotech has contributed to agricultural productivity in various countries is closely linked to the policy landscape governing this type of technology. ‘The lack of biosafety legislation, biotechnology policies, and absence of biosafety procedures in several countries continues to be a major gap and a significant impediment and discouragement to research institutions that are willing to undertake high-end biotech research and development,’ the authors state. This they write, is generally because ‘the institutional landscape does not encourage research and development with significant biotech content’.

With the exception of South Africa, foremostly, and to some extent Ethiopia, Ghana, Kenya, Nigeria and Sudan, most sub-Saharan African countries have weak enabling environments for crop biotech research and development, and adoption.

The World Bank report notes that in developed countries, investment in agricultural research and development amounted to 3.25% of agricultural GDP in 2011, while in developing countries, investment in agricultural research and development was just 0.52%. Africa and South Asia had the lowest spending relative to agricultural GDP and in half of African countries, this type of spending has been in decline. The report later explains why it is important for countries to spend money on developing technology solutions that are particularly suited to the farming conditions of each country, instead of just importing new technologies developed elsewhere.

Climate change, for example, will not have the same impact in every country, and to develop the type of biotech crops that can help farmers adapt to changing climatic conditions, these crops must be well adapted to local environmental conditions.

‘Such localised research and development capacity is essential for adapting technologies in specific areas and for specific needs. Thus, there is an essential role for the government in national agricultural research and development systems, both as a direct funder of public agricultural research and development and to create conditions to attract more private investment,’ the World Bank report states.

One example of a company that is investing in developing tailored solutions for farmers in Africa is UPL, the fifth-largest agrochemical company in the world. UPL is involved in a number of development projects for smallholder farmers in sub-Saharan Africa, such as providing extension support and using the company’s in-country networks to distribute hybrid seed and other technologies for trial planting by smallholder farmers.

According to Nishant Pahuja, business head for UPL in Africa, to improve farm productivity and farmer profitability, it is important that agriculture input suppliers offer customised solutions that specifically address the needs and challenges of farmers in different countries and in different growing regions within countries.

Pahuja adds that the affordability of new technology also plays a role. ‘The world is moving to new ways of doing things – we see a lot of excitement and acceptance for the new technologies and solutions that we can offer farmers. However, the adoption of these new technologies all depends on return on investment for the client, and that is why we hope to make our products more affordable to farmers.’

To give more farmers in developing countries access to new technology, such as biotech crops, increased spending is not only required in the research and development space – farmers often also face physical barriers that impede adoption of these modern farming technologies. No matter the degree of benefit that a biotech crop offers in terms of improved yield, for the farmer the bottom line is always whether or not they will be able to produce the crop profitably. And profitability is not only determined by yield per hectare.

As the World Bank report explains, ‘low farm-gate prices for commodities due to high marketing costs and policies that heavily tax agriculture can make technology adoption unprofitable’. Low adoption of improved seed varieties could also reflect ‘deficiencies in the enabling environment that empower farmers to access new technology and profit from adoption’, it states.

One example discussed in the report is the challenge posed to farmers in the majority of sub-Saharan African countries by poor rural infrastructure, which restricts not only their access to markets, but their access to farming inputs too.

In sub-Saharan Africa, the report states, the travel time to the nearest urban market is a major determinant of crop production, and for many farmers, the costs of even reaching the nearest road can be prohibitively expensive. It refers to a study showing that in Ethiopia the transportation and transaction costs of procuring fertiliser for a farm 10 km from the rural distribution centre can equal the cost of trucking the fertiliser 1 000 km from the port to the distribution centre.

The same study also found that as transport costs increased, so farmers used significantly less fertiliser and improved seed per hectare of cropland. It states: ‘With two-thirds of Africa’s population living more than 2 km from the nearest road, improving infrastructure to reduce farm-to-market costs may be critical to incentivising adoption of new technology and raising farm productivity.’